Achievement

Beat Holiday Blues: 4 Ways to Budget Ahead of the Holidays

How to Save Money, While Still Finding the Perfect Gifts

By Chelsea Vincent

If you’re stressed about holiday spending, check out these four tricks, to maintain your budget (and good cheer)!

With the holidays approaching, and festive decorations already lining the shelves of popular retailers, you might be wondering how to get ahead of seasonal budget blues. While we all enjoy the season of giving, from sharing favorite family recipes and traditions to exchanging gifts and kind gestures, no one enjoys the January holiday hangover, if we realize we’ve spent way more than we should have.

2018 is on course to be another record spending year. Last year saw the largest holiday shopping spending increase since 2011, and new tax codes mean many Americans have been more open to buying this year in general. But in the midst of the buying frenzies and shopping trips (or late-night online buying sprees), incorporating these four money tips can help you save money this holiday season.

- Set (and Stick to) a Number.

Before you get swept up in sales, come up with an amount you can reasonably part ways with during the holidays (covering gifts, food, and self-care). Then, divide this up, by creating an amount you can spend per activity, and then how much you can spend on a gift for each person on your list.

Once you’ve got this number in mind, stick to it. If you need to raise the cap on your holiday budget, consider taking on a side gig or putting in a few extra hours, to make sure you can cover any additional spending. And if Aunt Melanie’s designer handbag isn’t realistic for you, learn to say no. Instead, consider splitting the cost of a gift with others, or opt for something a little lower on the price list.

- Research Shopping Options

If you can get wish lists from family and friends ahead of time, you can be on the lookout for upcoming sales, by checking online advertisements or by asking helpful employees in-store. Also get prices on items, to see how they differ from one retailer to the next, and check if your desired stores offer price matching or free delivery, as both can impact what you have left over in the piggy bank.

Obviously, take advantage of the number one shopping weekend of the year, which saw 174 million shoppers in 2017. Black Friday, Small Business Saturday, and Cyber Monday are when retailers really slash prices, to clear inventory and to entice consumers, so prep ahead of time. Whether you prefer getting your hustle on in-store or adding eCommerce items to a digital cart from the comfort of your pajamas, make a plan ahead of time – may top items are only available at sale prices in limited quantities.

- Use Rewards Points Like Cash

Another clever idea to keep you from dipping too far into your bank account is using rewards points to help offset the cost of gifts. If you use your credit card to cover monthly essentials – like groceries, gas, and bills – you can convert those rewards points into holiday spending money, by transferring it to gift cards. Of course, avoid credit card blues in January by only spending what you can afford to repay quickly (don’t use this as an excuse to get the latest tv or iPhone model, as that defeats the point of budgeting).

- Give DIY Items or Time

Maybe you’re strapped for cash this year. Let’s say you’re saving for a home, or you have a kid on the way or in college. You can opt for no- to low-cost gifts instead. Flex your creative muscles, comb through a few Pinterest boards, and come up with meaningful, thoughtful gifts you can make for less, like holiday treats, gift baskets, or framed letters or artwork.

If you’re particularly handy or can offer your time, that’s often an overlooked – yet priceless – gift. People always need help with things like home improvement projects, babysitting, cooking – the possibilities are endless. A few hours of sweat can amount to more than a random gift that just sits on the shelf, and your help won’t be forgotten near as quickly as material items.

While the holidays are a time for joy and sharing, it’s important to spend in ways that keep those acts of goodwill moving into the next year of life. By crafting a holiday budget and giving creatively, you can ensure you won’t become a Scrooge, come January 1st.

Hi MR STEVE I watched your show every day I love ❤️ u I would like to play along with you in the money game please

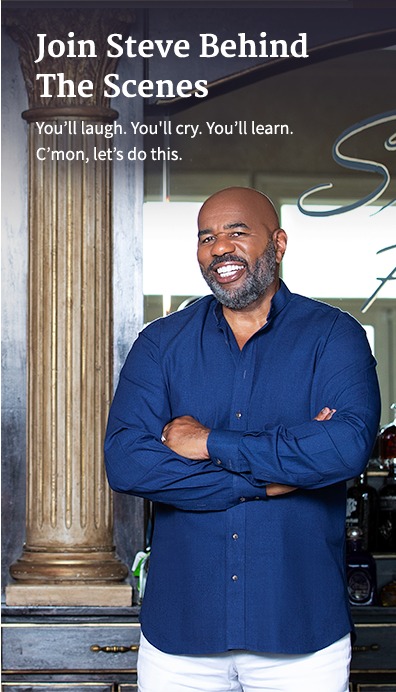

Download Steve’s app: https://steveharvey.com/harveyshundreds/ and play along!