Inspiration

How Does Compound Interest Work?

In partnership with Acorns

Written by Nancy Mann Jackson

Updated

You’ve probably heard the term “compound interest” before, but do you really understand how it works? If not, you’re in good company. In a FINRA Foundation financial literacy study, just one-third of Americans could accurately answer a question about compounding interest payments. Yet understanding this concept is key to making sure your money habits work for, and not against, you.

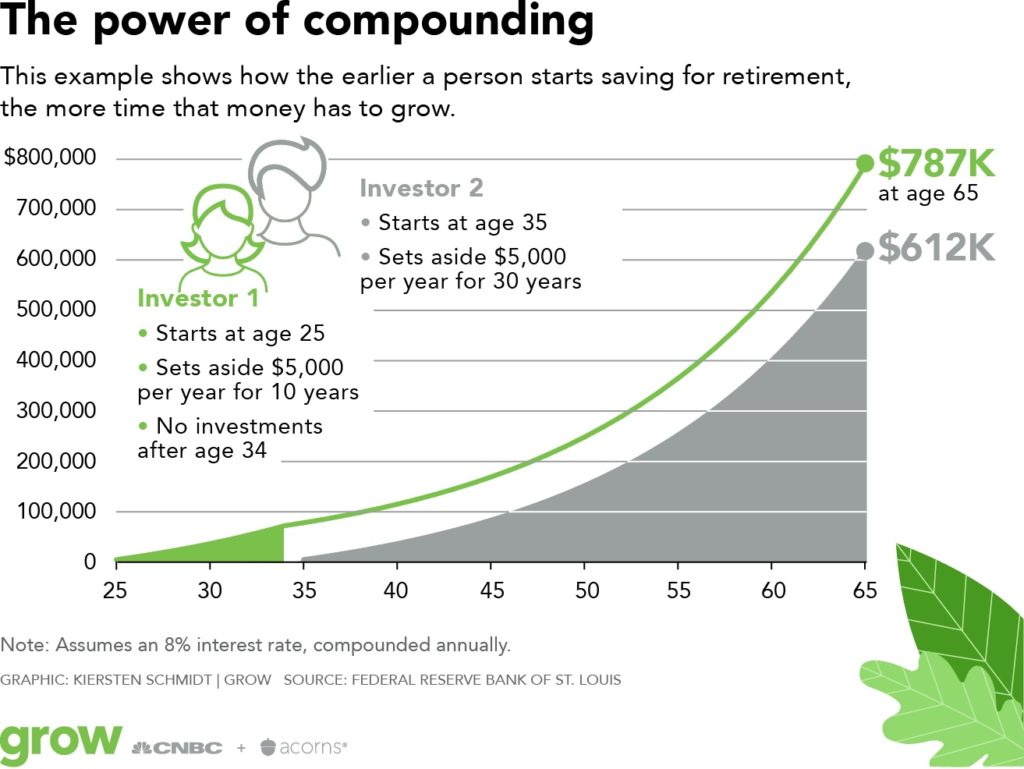

Take investing for retirement, for example. Compounding interest is the reason why we benefit from starting as soon as possible: Your early investments generate interest earnings, resulting in a higher investment for the next interest period. This cycle continues so that the interest you’re earning is continuously calculated based on a new, higher amount because it includes interest already earned. Basically, your interest earns interest, which earns more interest, and so on.

So compounding is a good thing?

When it comes to your savings and investments, compounding is definitely a good thing. (Savings accounts work on the compounding interest model, too, but current rates are much lower than you can reasonably expect from the stock market.)

As an investor, compounding interest is the quickest way to grow your money,” says Bryan Bibbo of the JL Smith Group in Avon, Ohio. “With compounding interest, over a long-term investment, you could put in a much smaller amount at the beginning and, 25 or 30 years down the line, end up with a huge sum. It is basically the idea that your money should work for you.”

But that doesn’t mean make one investment and then stop.

Making an investment in a compounding account and leaving it alone can result in steady growth over time, but that’s not the right approach for true investment growth. “Investors must keep in mind that for compounding interest to work, it must be fed,” Bibbo says. “Even though you can make a large return over a long period of time with a single investment, to take full control of the potential of compounding interest, investors need to form the habit of constantly saving and contributing at every given opportunity.”

Successful long-term investors lean toward products that offer compounding interest. Look for the APY, or annual percentage yield, which is the total return you’ll earn over a year. Bibbo recommends looking for investments with the highest yield and the most compounding periods.

What about when you borrow money?

Good thinking. If you owe money, compounding can work against you in some cases. Some types of debt, such as home loans, car loans and student loans, use simple interest. That means you pay the same amount of interest per month.

But other types of debt, such as credit card debt, use compounding interest. If you carry credit card debt from month to month, you aren’t just charged interest on your most recent purchases. You’re also paying interest on the interest charged from previous months. And that can add up fast.

Say you owe $3,000 on a credit card with an 18-percent annual interest rate. When that annual rate is divided into 12 monthly installments, that means each month, your card’s balance accumulates 1.5 percent interest. Because interest on credit cards is calculated daily (as opposed to weekly, monthly or annually), you’re charged about .05 percent each day for that balance.

If you skipped a payment in January, for instance, your interest in February will be determined based on the higher amount of $3,045. Even if you don’t skip payments but pay only the $100 minimum each month, it’ll take you almost three and a half years to pay off the balance—and you’ll fork over an extra $1,000 in interest.

The annual percentage rate (APR) is the amount you’ll pay in interest over a year’s time: If you divide the APR by 365, you’ll get the daily interest rate. Most credit cards calculate interest on a daily basis for any balances not paid by the due date. So the unpaid interest on past charges compounds incrementally every day. To make it even more confusing, different types of credit card debt (such as purchases, cash advances and penalties) may have different rates of interest, which compound at different times.

As a borrower, look for the lowest rate with the fewest number of compounding periods. “Borrowing with compound interest has the potential to get away from you if you aren’t careful,” Bibbo says. “The idea here is to pay down this debt as quickly and as reasonably as possible to keep the interest under control.”

Why is compounding so difficult to understand?

Many people have a hard time understanding how compound interest affects them because many common uses of interest in personal finance use simple interest. Because home mortgages, car loans and student loans all use simple interest, that solidifies many people’s experience with how interest works, Bibbo says. In addition, lenders often use unfamiliar terms (like APR, or annual percentage rate, and APY, or annual percentage yield) to promote credit products, and consumers often choose what sounds good even if the concept is murky.

To benefit as both an investor and a borrower, it’s crucial to understand compounding, Bibbo says. If your investment interest compounds, your money is working for you—but if the interest on money you borrowed compounds, “that money is working against you at a much faster rate,” Bibbo says.

If you owed $1,000 on a credit card with a 16 percent interest rate, simple interest would mean you pay $1,160 over one year. But credit cards operate using compounding interest—so the same balance with compounding interest requires you pay $1,172 over one year. Over the course of five years, your simple interest payment would be $1,800 but compound interest would be $2,214. “That is money working against you, money that can be used elsewhere,” Bibbo says. “As a borrower, not understanding compounding interest can put you in a hole that may be hard to get out of.”

What should I do with this information?

Remember that compounding interest is a beautiful thing for investors, which should encourage you to invest as much as possible, so you can see your money multiply over time.

And look for ways to mitigate the negative impacts of compounding interest on your debt. Negotiating with your lender to lower your interest rate, paying more than the minimum or, better yet, paying your credit card bill in full every month are the best ways to do that.

* Investing involves risk including loss of principal. Acorns does not offer an interest-bearing account. This information is provided for educational use only and is not a recommendation to buy or sell any specific security or invest in any particular strategy.

All investments involve risk including loss of principal. The chart shown represents hypothetical performance assuming a fixed annual rate of return of 8%, with earnings and dividends reinvested over the time periods shown. Such results do not represent actual investing results and does not take into consideration fees or economic or market factors which can impact performance. Clients may achieve investment results materially different from the results portrayed. The information shown is for illustrative purposes only and should not be considered as investment advice or a recommendation to buy or sell any particular security, strategy or investment product.

For more information visit: https://www.acorns.com/steveharvey/

More like this