Style

How Is Your Credit Score Determined And Why Should You Care?

IT'S MORE THAN JUST A 3-DIGIT NUMBER; IT'S YOUR FINANCIAL FUTURE

Credit is a confusing concept that’s all the more complicated if you aren’t taking the right steps to maintain a healthy credit score. But what is a credit score, how is it determined, and why is it important in the first place? These are things you need to know to help set you up for a sound financial future.

Today's Get Smart About Credit Day! Do you know these 6 common credit terms? https://t.co/CLGAqbjf2l

— myFICO (@myfico) October 19, 2017

Your credit score is a three digit number generated based on information in your credit report— data collected from previous credit accounts and loans. Any activity on your credit account impacts your score. This means that anything from paying an account late to having more debt than credit on your accounts can change your credit score and hurt your buying power.

This number directly reflects the amount of risk associated with your credit— with a higher number being ideal and a lower number suggesting that you’re a high credit risk.

Looking for a new car? Why you should check your FICO Score first! https://t.co/Pg2JzX08wZ

— myFICO (@myfico) September 5, 2017

If you find yourself in need of taking out a loan— whether it’s for buying a house or vehicle, paying for college, or handling big expenses such as a wedding or home repair— chances are you will need to go through a lender in order to secure those funds.

Reputable lenders check your credit score before approving any loans, but also use your score to determine how much interest they should charge on your loan if they approve you. A lower credit score will result in a higher interest rate in order to secure a larger return in exchange for the lender’s greater risk. This means you’ll end up paying much more than you borrowed to begin with.

It isn’t just loans that are impacted by your credit score; it can also influence your home, work, and love life. If you rely on renting for your house or apartment, it’s important to know that potential landlords check credit scores to determine if you would be a fit tenant (meaning, one that would pay rent on time).

If you are on the job hunt, keep in mind that employers can— with your permission— check your credit score in order to determine your hireability. If the job requires a certain amount of discretion or reliability, employers will see a low FICO score as proof that a candidate doesn’t meet their needs and can legally pass on their application.

Don’t think your credit score can affect your love life? Think again! https://t.co/KRgr5vMVBq

— myFICO (@myfico) September 3, 2017

Poor credit can also impact your ability to find love. It’s been reported that 70% of married couples fight about money and 42% of Americans say that knowing someone’s credit score would have an impact on their interest in dating them, so single people are feeling more encouraged to take finances seriously from the very beginning of a new relationship. A low credit score indicates a poor relationship with finances and can cause friction between potential partners and makes it hard to find the love you’re looking for.

Your credit score may just be a three digit number, it actually impacts a lot more than you think. Start seeing it as something that you can actively control and you’ll start to have a better handle on your financial— and personal— future.

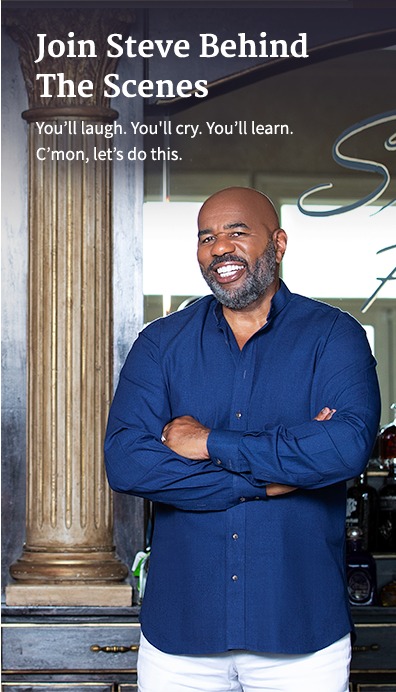

I’m looking for the gentleman that Mr. Harvey uses on his show to help with credit problems.

Please visit SteveTV.com.

This is certainly literally the finest thing I’ve

go through this week! Like, https://ideenkicker.ch/pathfinder-wrath-of-the-righteous/ did that will to me last few days,

but that post has certainly produced my day much better. Thank you for

a lot exclusive and insightful info, always!