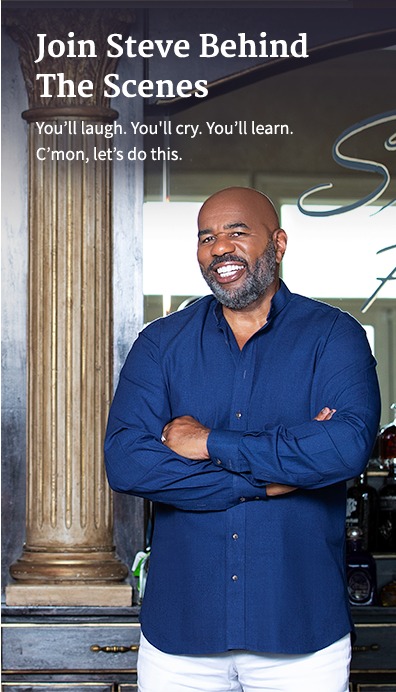

Style

3 Money Moves To Make Before You’re 30

TAKE THESE STEPS FOR A BETTER FINANCIAL FOOTING IN YOUR 30'S

The financial decisions you make in your twenties can follow you through the rest of your life, so it’s important that you make sound ones.

In order to get the most out of your money, these are the moves to make before you hit 30.

1. Contribute to retirement early and often

It may seem a little early to be thinking about retirement when in your twenties, but doing so at this early phase has huge implications for the future of your finances. When you reach retirement age, you‘re able to draw an amount from Social Security based on how much you’ve made during your 35 most lucrative working years. However, the average amount of Social Security payments can barely cover the cost of living. That’s why it’s so important to have another means of income during retirement.

Whether you have a 401k through your job or you decide to invest in another option such as a Roth IRA, it’s important to have some sort of plan for retirement that you contribute to early and often. If your retirement plan through your employer does a 401k match to your contributions, that’s free money! You should increase the percentage that you contribute to the highest that will qualify for a match and get the maximum investment you can. The same goes for other retirement funds; start your contribution early and add to it often for the greatest amount of growth.

Though these plans are a great way to squirrel away money, be careful about the temptation of early withdrawal. With most retirement accounts, there is a penalty attached to early withdrawal that can really cut into your savings. Instead, allow your money to grow and you’ll be able to retire in style.

2. Start an emergency savings fund ASAP

You never know when an emergency situation is going to spring up. That’s why you have to plan for the worst while hoping for the best. With that philosophy in mind, it’s important to establish an emergency savings fund in your twenties.

The first step is to assess your monthly income versus your monthly spending. Once you look at the actual account of your finances, you can set a goal regarding how much you would like to save per paycheck. From there, you can choose an account that will allow you to withdraw when needed without penalties. A savings account attached to your regular checking account is the easiest to establish, but there are plenty of options to investigate before choosing a savings account.

The best way to save what you intend to save is to have a direct deposit going straight to your emergency fund. Doing so will remove the hassle of remembering to contribute. With this account established in your twenties and growing steadily, it’ll always be there when you need it the most.

3. Make debt history

Student loans incurred during your years of education can impact the rest of your life, thanks to their high interest rates and tax implications. That’s all the more reason to make sure this debt is wiped out quickly and completely.

Just like starting an emergency savings fund, you need to assess your income versus your spending in order to determine how much you can afford to pay on your student loans per month. It’s important to note that paying more than the minimum paymenteach month will have huge benefits such as saving on interest and increasing your credit score.

Paying off debt is important no matter what kind of debt it is. Whether it’s a home loan or a credit card, maintaining low balances, paying your bill on time, and keeping a cushion of available credit will benefit you in your twenties and beyond. Remember: debt is inescapable at times, but that doesn’t mean you need to be saddled with it forever.

Your twenties may be a time to discover yourself, but it’s also the time to establish your financial future. Make the right moves early on and you’ll enjoy a life of financial freedom that will make all your hard work well worth it!

The post shows some burning questions and issues that needs to be

discussed and explained. In addition, it is

essential to grasp within the detail. In the article,

one can easily find something fundamental, remarkably

for him personally, something that will be exceedingly useful.

I am delighted with the information I have just got.

Thank you a lot!

Each of us has a proper understanding of the advice given to the general public, so that I truly liked the guide and expected you to provide us

with more things similar to this one.

The guide is bright and clear, with no further worthless details or else.

The language is both brilliant and vibrant, so the further I read, the

more I do like it!

I enjoyed the guide and suppose you have more such stuff?

If yes, so please post it because it is somewhat uncommon for me

at the present instant, and not only for me personally, that is my own opinion.

The more I see, the more the better your content is.

I have covered a lot of their other resources; however,

only here, I have found legitimate information with this kind of

essential facts to keep in mind. I suggest you’ll print articles with various

topics to upgrade our knowledge, mine in particular.

The language is another thing-just brilliant!

I believe I’ve found my ideal supply of the most up-to-date information, thanks to you!

Very educative and inspiring information.

[…] are a lot of actions you can take to ensure better financial stability. But if you’re stuck in a dead-end career, it might be […]