Inspiration

What Is an Emergency Savings Fund?

In partnership with Acorns

Updated April 9, 2020

Are you ready for the next financial curveball life throws your way? Forty-nine percent of U.S. households say they’d have to rely on credit to cover an unexpected expense, according to The Pew Charitable Trusts. Over a third would resort to borrowing money from someone they know.

Enter the emergency fund. Whether you’re faced with a medical emergency, job loss, or surprise home repair—or anything in between, really—this stash of money is designed to get you over the hump without tanking your budget. Think of it as your financial safety net.

How big should my emergency fund be?

Most financial planners recommend setting aside three to six months’ worth of expenses. You may want to dial that number up if you’re questioning your job security or live in a one-income household. According to a recent Bankrate survey, 36 percent of people who experienced a major unexpected expense over the past year were set back at least $5,000

That may sound like a huge chunk of money, but take heart in knowing that no one saves this kind of cash overnight. Start where you are—whatever that looks like. Setting the goal of saving just $500 can stoke your motivation and instill the habit of saving a portion of every paycheck.

How do I supercharge my savings?

Freeing up money to funnel into your savings account isn’t always easy. This is why budgeting is so crucial. A solid budget makes room for your regular bills and bigger money goals, like throwing cash into your emergency fund each pay period. In other words, the path to a healthy savings account is intention.

Checking in on your spending and course-correcting as needed is simply part of managing your finances. If you’re at the starting line here, revisit your budget to get an idea of what’s working and what’s not. Zero in on any expenses you can bring down, and then redirect those savings straight into your emergency fund. This may translate to canceling unused subscription services, talking down your phone bill, or rethinking your premium TV package. Little savings like these add up.

Cash windfalls are another powerful way to top off your emergency fund a little faster. (We’re looking at you, annual tax refunds and work bonuses.) The next time you land a pay raise, consider maintaining your current budget and putting all that additional money each paycheck right into your savings account.

The key is to make things as routine as possible. Put your savings contributions on autopilot by having them automatically transferred out of your checking account each pay period (out of sight, out of mind). It’s a move that could very well put you ahead of the game when it comes to your savings rate. One 2005 study found that employees who were automatically enrolled in a company 401(k) were more likely to save for retirement.

Should I pay down debt or build my emergency fund?

Who says you can’t do both? It may feel counterintuitive to focus so hard on building an emergency fund when you’re staring down a pile of debt, especially with average credit card APRs now exceeding 17 percent, according to the Federal Reserve. What’s more, CreditCards.com reports that the typical U.S. adult with a credit card owes about $5,673.

With numbers like these, it may be tempting to direct 100 percent of your extra income toward knocking down those credit balances—but establishing your emergency fund is important. If you’ve got nothing in savings, how will you weather your next financial storm? Having cash reserves on hand plays a crucial role in breaking the debt cycle.

This is precisely why some financial planners suggest setting your initial savings target at $1,000 if you’re simultaneously paying off high-interest debt. After all your bills are paid each month (which includes your minimum debt payments), divvy up whatever’s left between accelerating your debt payments and establishing a starter emergency fund.

Once you get your savings up to the $1,000 mark, begin hitting your debt hard until it’s paid off. At that point, you can ratchet up your savings focus again. The takeaway: Working toward multiple financial goals doesn’t have to be an all-or-nothing endeavor.

Where should I keep my emergency fund?

What good is your emergency fund if you can’t easily withdraw funds in a pinch? Accessibility is the name of the game. You’ll have to jump over more hurdles to access money that’s invested in a CD or 401(k), for example. And you can expect to pay hefty fees for doing so. Dipping into your 401(k) or traditional IRA before you’re 59 ½ will trigger a 10 percent penalty. That’s on top of the income tax you’ll have to pay on the withdrawal.

If you truly have nowhere else to turn when disaster strikes, a Roth IRA can be a last-ditch emergency fund since you can withdraw funds at any time, penalty-free. But think long and hard before you go this route. Pulling your money out of the market now means missing out on future returns later—and draining your nest egg is something you may regret when it comes time to retire. Still, the number one reason people tap their retirement savings early is to cover a financial emergency, according to a recent GoBankingRates survey.

The best place to keep your emergency fund is in a liquid account you can easily reach when you need it. A high-yield savings account is an attractive option because it makes your money work a little harder for you. Turn your attention to online options. While the national average APY (annual percentage yield) for a savings account is just 0.28 percent according to DepositAccounts.com, some online accounts offer rates as high as 2.75 percent. That’s a nice little payout you can pretty much earn in your sleep.

Wherever you keep your emergency fund, safeguard it from temptation by parking it at a different bank from where you keep your checking account. What matters most is that you prioritize building (and protecting) this financial cushion. You’ll thank yourself the next time you’re hit with an unexpected expense. Start small, automate your efforts, and watch your balance gradually grow.

This article contains the current opinions of the author, but not necessarily those of Acorns. Such opinions are subject to change without notice. This article has been distributed for educational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

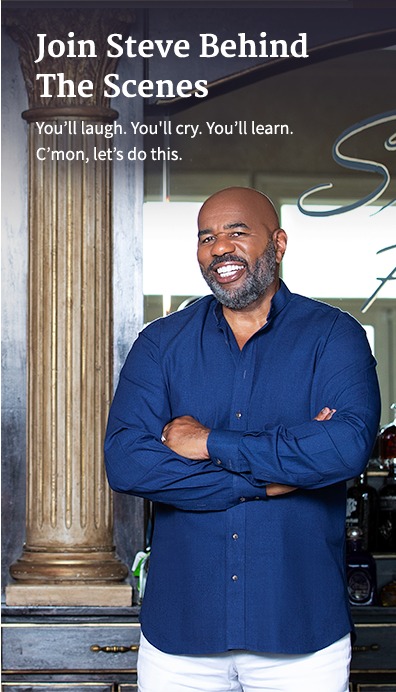

For more information visit: https://www.acorns.com/steveharvey/

If you truly know how to save, but lost half of it through no fault of your own, right after you retired.