Achievement

Get Smart With Your Saving Habits

By Chelsea Vincent

Stuck wondering how to save money? Don’t miss these basics on how to get your financial act together, no matter what you make.

Recently, my grandmother (affectionately called Grammy) commented that the reason most young people today (read: 20- and 30-somethings) can’t afford homes is that we buy more things than her generation did. And to some extent, she’s right.

Now, don’t get me wrong — I definitely presented to her some hard-hitting obstacles we’ve got to deal with these days, like:

- On average, rent is a whopping $1,442 per month

- We will pay 39% more for a first home than baby boomers in the 1980s

- The cost of having children is now higher than ever

Just reading those is enough to make you want to hide in your childhood bedroom forever. There’s a huge mountain to climb when it comes to being financially independent — and even successful — in the world of today.

However, where Grammy had a point is in the way that many people have responded to these challenges. For each person who sees these statistics as challenges to overcome, there are also people who say, “I’ll never be able to beat those odds, so I’m throwing in the towel and spending my money on $14.95 avocado toast, concerts, and the latest iPhone.”

That’s where we have some room for improvement. A staggering 49% of millennials have no retirement account, and those who have debt owe an average of $40,000. I’m all for documenting memories, and I like trying out cool filters as much as the next person, but do we think the Instagram photos will keep us happy and fed when we’re in our seventies and eighties?

What many people fail to realize is that you don’t have to come from a wealthy family, or even have a college degree, to be wise with your money. Many of us didn’t learn about savings strategies or establishing credit in school (who knows why this isn’t mandatory high school learning — that’s another post). But with the internet available 24/7, we can learn how to save money now, and we sort of owe it to our older selves.

At a basic level, smart savings starts with living within your means. In other words, you need to make the most of the money coming in, while wisely spending or investing the money going out.

Set a monthly budget (and have the discipline to follow it). We know – setting a budget isn’t the most riveting activity. But rather than procrastinating, taking the time to write out a budget is something anyone trying to be independent needs to do, no matter how much you do (or don’t) make.

Separate your wants from your needs. Make the things you have to pay for each month your priorities — like rent, utilities, car loans, and insurance — and then make sure you also have an allocated amount for groceries and savings. Also set up budgets for the fun things in life like travel, meals out, and gifts. Then, stay within your spending limits for each category. The concept may be simple, but the execution requires some willpower.

Manage debt. Get out of debt asap. Obviously, this will take longer for some than others, but you need to work toward this like you are training for an Olympic event. If you need to get a temporary side hustle (or three), do it. Defaulting on loans can sabotage your credit score, which can haunt you down the line.

And speaking of credit, while credit cards are a bit of a necessary evil (as you need to establish good credit), use them only for purchases you can pay off quickly, to keep you from getting further into debt and owing interest.

Set up automatic transfers to your savings and retirement accounts. You can live like a saint, but life still happens. At some point, you will need to pay for car repairs, medical bills, or other “adulting” expenses, so you need to have a pot of money put aside for those needs, not to mention money for when you can’t work as much as you do now.

On average, we’re living longer, which means we’ll need money longer. Unfortunately, it’s not nearly as fun to think about paying for groceries at age 79 as it is to splurge on that new outfit or pair of shoes. But again, which one do you actually need? As an added incentive, the younger you start putting money into a Roth IRA or other investment account, the more money you’ll get back in the long run. Ka-ching!

Yes, living today means some added financial challenges. But, let’s be real – it also means we have access to advanced technology, longer lifespans, and broader career options. So instead of getting bogged down in the hurdles, make saving smart a part of your broader life affirmations, and get to work. You’ve got this, boo.

I am trying to figure out how do one save when they don’t make enough to save?

I really enjoyed your article and I look forward to reading more of your financial planning advice.

Thank you for sharing

I’m truly going to start ????

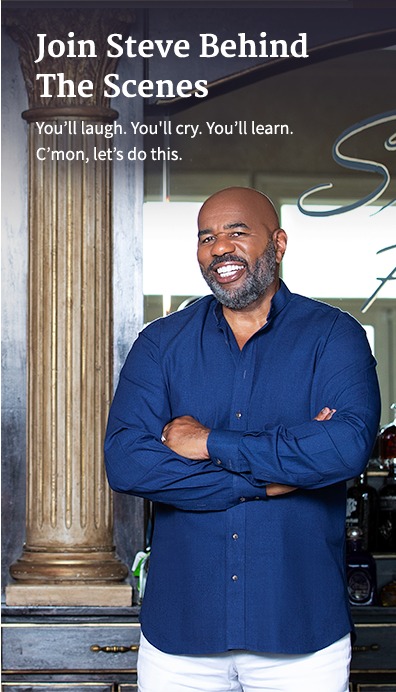

Steve I’m Starting late but I will stick to it. Thanks for the guidance…

What is the name of the book the financial expert you had on past Monday?

I would love to purchase it.

That s my first day on Steve’s page and I find it very useful and interesting. Thanks guys for ur posts.

Steve, I am so glad that you are a fellow Christian. I have always love the fact that you were so positive and gave great advice to the people. I saw your videos and the one that you did titled “you have not because you ask not” just blew me away.

I am a representative for a company that helps people restore their credit and gives them an instant pay raise their next payday. I’m sure you get a lot of things like this so if you do not want to look into it I understand.

Be blessed my brother and if we never get a chance to break bread together, I will see you in heaven.

Steve you’re right on with a device I have my retirement plan my Roth but my real struggle is saving money on an everyday basis trying trying not to eat out which is a big money consumer I love my food and it’s so convenient to go sit down and eat then go home and cook I need to work on it thank you Uncle Steve.

Hello,

I wanted to tell Steve Harvey thank you for his TV advice on dating men. I lost my husband in 2014 and knew I wanted to date but did not want to go to online dating. I also, was going to only date men that matched my spiritual sign. Steve had a show that he discussed opening up and date different men and signs.

I took Steve’s advice, met the the most wonderful man. We have been dating for 3 yrs. I would have never done this if I did not hear Steve telling the audience about dating. I would have missed meeting this man. Best thing we new each other for years but, never contacted each other. He lost his wife to cancer as I did my husband. Our dating started when I feel off my bike in front of his house to say hello.

I also, asked him to fulfill my bucket list (take a ride on a Harley) he reluctantly took me. Wow it was so much fun and many laughs too.

We are seniors (OLD) I was married 56 years and really thought I would never date again.

Life is beautiful again for both of us and our families get along really well.

Thank you Mr. Steve Harvey

Your the best

Wishing you the best retirement.

HOPE Steve gets to read this.

I really like this write-up, I will start soon by the grace of God. I really appreciate, looking forward for more from you.